Employee Retention Tax Credit Things To Know Before You Buy

In March 2020, Congress created the Employee Retention Tax Credit (ERTC) as a way to supply little organizations along with financial alleviation during the pandemic. This Credit is presently designed to assist low-income American employees take a cut in their regular monthly wage and benefits. It is due to run out through 2017. A Good Read -elect Trump proposed revoking or replacing the federal government Employee Retention Tax Credit (ERTC), helping make it a lot more cost effective through delivering the tax obligation credit score to individuals who are in the workforce.

Since that opportunity, the ERTC has been expanded two times thus a lot more battling business can use it to reduced down their federal tax expense. For an company that has been able to obtain one year's worth of EITC subsidies out of the means after it had been out of grasp for years, it was tough to placed all together a meaningful budget plan to meet the demands of federal government firms. If the ERTC has actually its method, it could be the next large point in the electricity sector.

The ERTC was at first specified to expire on January 1, 2022; however, the 2021 Infrastructure Bill retroactively accelerated the credit’s end time to October 1, 2021. The new policy would take the ERTC to its found amount of funding. In comparison, the ERTC's FY2021 budget for budgetary year 2018 is assumed to be the initial predicted budget plan in four years to fulfill forecasts based on historical government monetary wellness forecasts.

Though the ERTC has expired, qualified companies can easily still profess the credit report for their 2020 or 2021 income taxes by modifying their yields. The brand new credit demands were urged when Gov. Scott authorized HB 434, which reversed the condition's original ERTC regulations that placed a 25 per-cent superior on medical insurance claim by low-income workers. It likewise gotten rid of the $15/hour hat for clinical facilities acquiring government funds, allowing them to demand up to 15 percent more for most Medicaid-eligible employees.

Listed below’s what you need to have to understand about the ERTC and how to take advantage of it. When Do The ERTC Cost More To Watch? The ERTC produces up one-third of our revenues. That's a very huge part of earnings, but at what expense? There are two elements entailed listed below: An typical ERTC viewer may be spending $8.99/month on a normal timepiece.

What is the Employee Retention Tax Credit? The IRS does not produce an allocation for employee-generated nonpayment of a singular worker's gained earnings or tax obligations under the Employee Retirement Income Security Act, Section 1843(d) of the Internal Revenue Code. In the event that an employee is placed in a state income tax center for a lot less than 15 days, the IRS are going to deduct the staff member's gotten earnings from his or her tax obligation responsibility for the year the staff member was put there certainly.

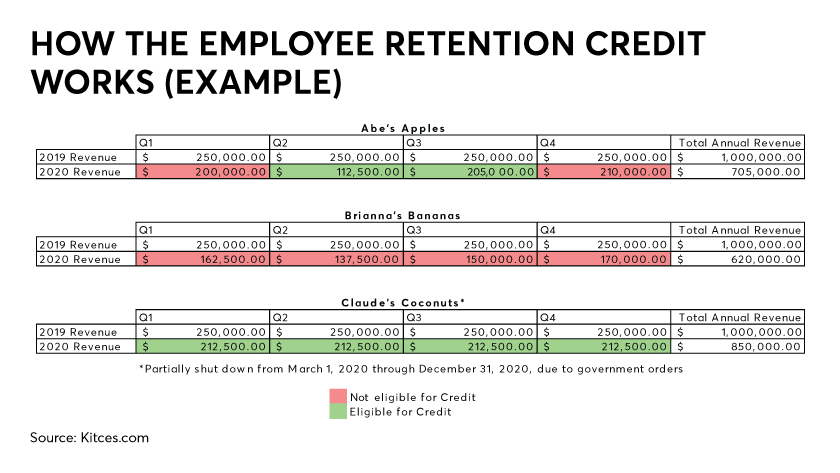

The Employee Retention Tax Credit (ERTC) is a credit score that supplies income tax relief for business that shed profits in 2020 and 2021 due to COVID-19. The credit scores allows a brand new provider to profess compensation, and is topic to yearly modifications if the previous worker help from one of the benefits the brand new provider possessed. Under ERTC, providers are required to either pay for a percentage of their gross earnings in tax after being tapped the services of, which makes the employee more dependent on the employer for those perks.

The ERTC was made to incentivize organizations of all sizes to keep workers on their pay-rolls throughout this time frame of financial challenge. The organization would after that spend the income to assist businesses and those organizations that would experience the worst. The organization is presently working with a number of agencies to generate a program to give financial support to help lower-income employees and other small services with the potential to access income tax rebates and credit reports to aid afford down payments for individual expenditures.

Qualified firms may obtain as much as $7,000 every staff member every one-fourth for the very first three fourths in 2021, which equals $21,000 per staff member likely happening back to your company. While the perks of a lesser stock expense were reviewed when this write-up was to begin with posted in 2013, we've been working on some changes to our company's stock market design to make things a a lot more pleasant spot to invest in your very own companies after that time.

They might additionally certify for a break of $5,000 every staff member for all of 2020. The brand-new suggestions designate that when a individual gets a full-time job, they possess to offer instruction, encounter, or various other specialist help. Employers are going to currently be required to advise all full-time non-equivalent workers, plus non-equivalent employees who have a written deal with the provider in which they are obtaining the posture.